Table of Content

Irregular payments are another variable impacting loan balance and repayment timelines. Some lenders allow you to delay repaying your debt and simply pay the interest charges for a limited time . If your lender passes on a rate cut, you could save money on your mortgage repayments, but if rates rise, you could find yourself paying more. You can use comparison rates to help you compare the cost of different home loans with similar features. When deciding which home loan is right for you, it’s important to think about what features each home loan offers, and how much these matter to you.

It will calculate each monthly principal and interest cost through the final payment. Great for both short-term and long-term loans, the loan repayment calculator in Excel can be a good reference when considering payoff or refinancing. Download this Excel loan calculator and take charge of your financial obligations. Today’s mortgage rates vary with market conditions, but the rate you’re offered also depends on the riskiness of your financial profile. A lender must assess whether they believe you’ll repay the home equity loan on time.

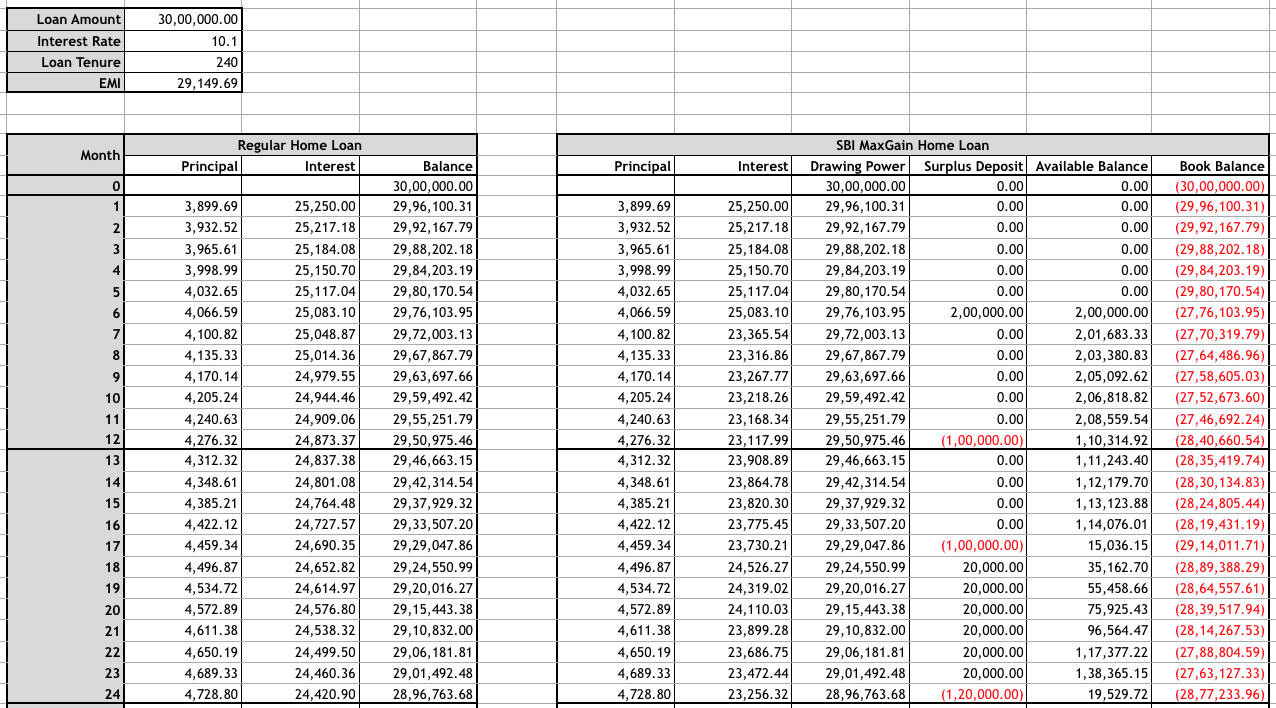

How can an offset account help you pay off your home loan sooner?

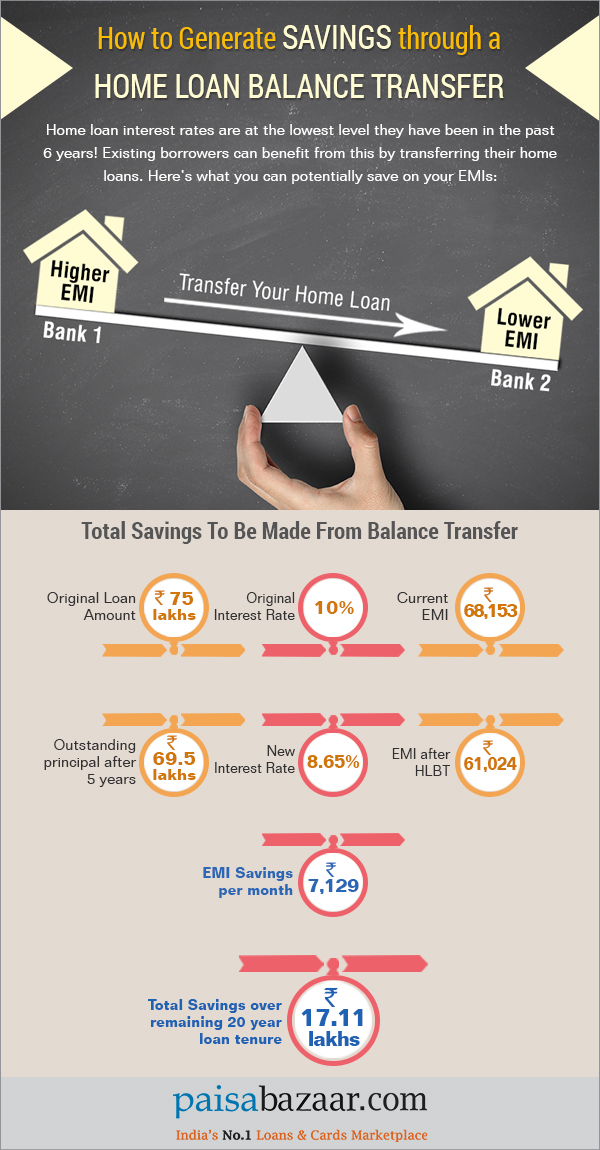

Interest is the amount of money the financial institutions charge on top of the principal amount. It is calculated based on the home loan interest rate and the principal amount. The interest is added to the principal amount to make the monthly EMI. Received multiple home loan offers of varying tenures and interest rates? Compare them by figuring out the monthly instalments for each offer using the home loan EMI calculator.

Estimated repayments and repayment scenario comparisons are estimates only based on the loan amounts, loan types and loan terms selected. The comparisons are indicative estimates for illustrative purposes only and are based on current interest rates . For most of us, life’s most gratifying and rewarding project is owning a house.

How is a Home Loan EMI Calculated?

In the monthly reducing cycle, your prepayment will be taken into account only when the next EMI is paid. Over time, interest savings are significant and repayment periods diminished. For example, mortgage holders making annual payments totaling a single additional monthly payment trim years off their original loan satisfaction dates, saving on interest expenses along the way. Irregular payments change the course of repayment though, disrupting orderly amortization schedules in the process.

Overall, making additional principal payments can be a win-win if you are disciplined enough to make the additional payments on a regular basis. If you can pay an extra $100 per month towards principal on a $100,000, 30-year mortgage, the average time shaved from the loan is nine years. Getting a home loan is the biggest financial decision you make in your life. Nowadays, with most lending institutions reducing the amount of paperwork, availing a home loan is a simple process. With everything in order, your home loan can be sanctioned in as less as 24 hours as well.

Savings Rates Are Sky High Right Now. 5 Examples of What That Means for Your Money

Housing Loans are one of the most flexible credit options that are available to borrowers, to fund the purchase of their residential property. Often, depending on the borrower’s requirements, the lender can disburse the home loan amount in parts. Till the full loan amount isn’t disbursed to you, you are required to repay only the interest component of the principal loan amount.

This will remove the co-signer’s name from the deed and will effectively transfer ownership to you. Three days before closing, make sure your closing cost statement is in line with your loan estimate. There are also specific seasoning periods for loans backed by the FHA, VA or U.S. Our new joint loan application is launching on January 7th 2023.

A number of the above factors - reducing your loan balance, mortgage rate and mortgage insurance premium - can contribute to making your monthly payments lower. This is another good use for a mortgage calculator - it can show you how much less of a burden your monthly payments will be if you start off with a larger down payment. Home equity loan interest rates are almost always fixed, which means they’re stable throughout the life of your loan.

HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement. Home Loan EMI Calculator assists in calculation of the loan installment i.e. It an easy to use calculator and acts as a financial planning tool for a home buyer. If you have been in your home for a while or property values in your area are rising, downsizing is the best way to pay down your mortgage fast.

A longer tenor can help with smaller EMIs, but the total interest compounding on your Home Loan will be higher. With so many interest rate options and repayment types available, finding the cheapest home loan may depend on the type of loan you choose. Split - Some borrowers also choose to split their home loan interest rates between fixed and variable interest rates. This can provide a bit of certainty in case of rate rises, while also making the most of low rates when they're available. Any money that you put in your offset account is included when your lender calculates the interest owing on your mortgage.

Keep in mind that you may not necessarily pay the comparison rate that is advertised for your loan type. This is because, for example, you may not pay all the fees and charges which the comparison rate includes. Based on the combination of factors that you select, the loan repayment calculator will automatically adjust the interest rate per annum and estimate your repayments accordingly. Estimated repayments are calculated on a monthly basis by default, but you can adjust the frequency to weekly or fortnightly if you’d like to compare the difference.

Calculate the total costs of an FHA loan and compare it against low downpayment offerings from Fannie Mae and Freddie Mac. It is possible to borrow from your 401 plan, in some cases to fund a larger down payment. Cutting savings to the bone to increase your down payment can backfire, since buying a new home often means dealing with unexpected expenses.

The EMI calculator helps you arrive at the right home loan amount that best fits your monthly budget, by helping you decide the loan EMI and tenure most suitable to your financial position. An EMI calculator is useful in planning your cash flows much in advance, so that you make your home loan payments with ease whenever you avail a home loan. In other words, an EMI calculator is a useful tool for your financial planning and loan servicing needs. The significant down-payment, and less expensive home, makes short-term mortgages a reality.

Instead, use the Bajaj Finserv EMI Calculator to calculate your EMI with ease. You can also calculate the EMI on home loan manually using the below formula.

Another thing that can lower your monthly payment is paying interest on a smaller principal amount, possibly over more years. You can reduce your long-run interest costs through a lower mortgage rate, shorter loan term or both. When you refinance, you get a new mortgage to pay off your existing mortgage. You’ll be free from the stress of home buying and moving, though, and there’s less pressure to close by a certain date. Further, if you regret your decision, you typically have until midnight of the third business day after your loan closes to cancel the transaction. When you apply for a loan, based on your circumstances, we might give you the option to defer your first repayment.

No comments:

Post a Comment